Table of Content

They have enough income now and anticipated in the future to manage their payments. Every mortgage loan must be underwritten before it can be approved and closed on. One of the most unknown yet noteworthy benefits of VA loans is that they are assumable. All units must have separate utility services or joint water, sewer, gas, and electricity lines. If you meet any one of the below conditions, you can qualify for a VA mortgage as a spouse. You were discharged due to a reduction in forces, early-out or at the convenience of the government.

Credit scores change, income levels change, and a Veteran not able to purchase immediately may find their way to homeownership as soon as months after the original denial. Despite the reams of documents and sophisticated computer programs, home lending is ultimately a business comprised of human beings. That means there's always a chance for something to go wrong. If you're here, the odds are you're hoping to prevent any hiccups in the homebuying process, or your VA loan may have just gotten denied.

When Manual Underwriting May Be Required

The highest we have closed in recent history was a 65% back-end debt-to-income ratio. The VA does spell out very specific residual income requirements that must be met. They’re here to ensure the lender is making a good investment. Underwriters will go over your loan file with a magnifying glass. It’s their job to make sure your file meets all the requirements, and that you’re a safe bet when it comes to making those mortgage payments on time, month in and month out.

If you’re trying to figure out how to apply for a VA home loan, you should first find out if you qualify for one. There are some additional steps to get approved, as well as various qualifications that you must meet. This allows lenders to provide mortgages at lower interest rates. Some lenders might allow a DTI ratio above 50 percent, even well above it, in some cases, depending on the strength of the borrower's overall credit and lending profile. The VA doesn't set a maximum DTI ratio but does provide lenders with the guidance to place additional financial scrutiny on borrowers with a DTI ratio greater than 41%. Compensating factors will allow an underwriter to “offset” credit profile deficiencies by documenting that there are sufficient conditions that reduce the risk of default.

Common Reasons VA Loans Get Denied and What You Can Do

However, all applicants must apply for the COE to validate their eligibility. A VA loan appraisal is an assessment conducted by an appraiser to determine the property’s actual value and ensure that the house meets all the MPRs. The result of an appraisal can affect your VA home loan application in various ways.

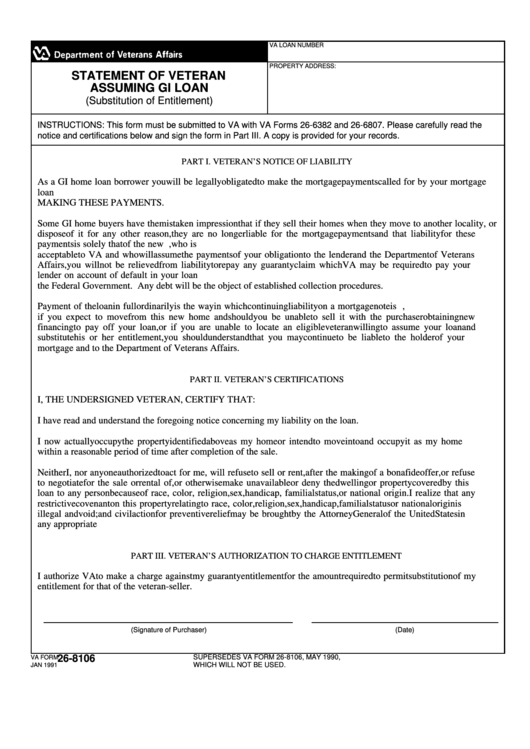

We have seen every credit profile under the sun and can give pointers on how to get your scores up. Loan applications that receive an AUS approval can allow lenders to proceed with less paperwork and fewer documentation needs. If you’re asked to provide additional documents, strive to get them back to your loan officer as soon as possible. Sending incomplete or illegible documents can delay the process. Talk with your loan officer if you have any questions about what’s needed.

VA Guidelines – Previous Mortgage Foreclosure:

If you are applying for a VA guaranteed loan, choose a loan officer that has experience with VA loans, and more specifically, VA manual underwriting guidelines. Unverifiable income, undisclosed debt and even minor errors like the number of family members can cause problems. The best thing you can do is ensure your information is accurate and bring anything that looks off to your loan officer's attention.

These would need to be repaid or otherwise satisfied before a loan could close. Unpaid debts or liens with the IRS that don’t appear on your credit report can still show up on title work later in the loan process. While it is not necessary for you to have an excellent credit score to qualify for VA loans, you must satisfy the lender’s requirements by having a minimum credit score of 620. If you don’t meet the minimum service requirements for a VA Loan defined by the VA, you might still qualify for the loan if your discharge falls under one of the following categories. Tim Alvis (NMLS #373984) is a residential mortgage loan originator at Veterans United Home Loans and a previous credit expert in the Lighthouse Program. Tim has helped hundreds of veterans and service members with their credit and financial profiles to help them go on to secure the home loan they deserve.

However, it’s more common for underwriters to offer a conditional approval instead of outright denying you the loan. If you’ve served for at least 90 continuous days , you meet the minimum active-duty service requirement. You may be able to get a COE if you didn’t receive a dishonorable discharge and you meet the minimum active-duty service requirement based on when you served. This is also a rare occurrence, and it’s not likely to happen if you’re working with a good loan officer who knows VA loans.

Veterans facing a manual underwrite will likely need to meet tighter requirements for things like debt-to-income ratio, derogatory credit, financial documentation, and more. A file that gets bounced from the automated system may be eligible for a manual underwrite. This means a real, live underwriter will have to crunch the numbers and evaluate the risk from Day One, rather than later in the process like normal. Your loan file is being underwritten manually, by hand, from the start. It’s often the case that before a final approval can be made on your loan, certain conditions will need to be met. All this means is that, for the most part, your loan is good to go, but there are a few little things that need to be addressed before you can close.

However, you must meet the minimum service requirements defined by the department to establish your VA Loan eligibility for COE. On VA loans, lenders will also include an estimated cost for monthly utility bills, multiplying the home's square footage by 0.14. Should this happen, ask your lender if they are able to manually underwrite VA loans. It’s much more work for the lender and the underwriter, and may require much more documentation from you, the borrower – but don’t take NO for an answer. When manually underwriting your VA loan, the underwriter is doing a combination of things. In some cases, the underwriter is only looking for alternative documentation to satisfy a requirement of the automated underwriting decision.

Here’s the ultimate guide to VA loans and how you can qualify for these benefits. One is to hold off on buying a home until they have a better balance of debts and income. Only certain types of debts and income count toward your DTI ratio. VA lenders will take a deep dive into your finance to determine if you are eligible for a VA home loan. One of the most important metrics is the Debt-to-Income Ratio.

No comments:

Post a Comment