Table of Content

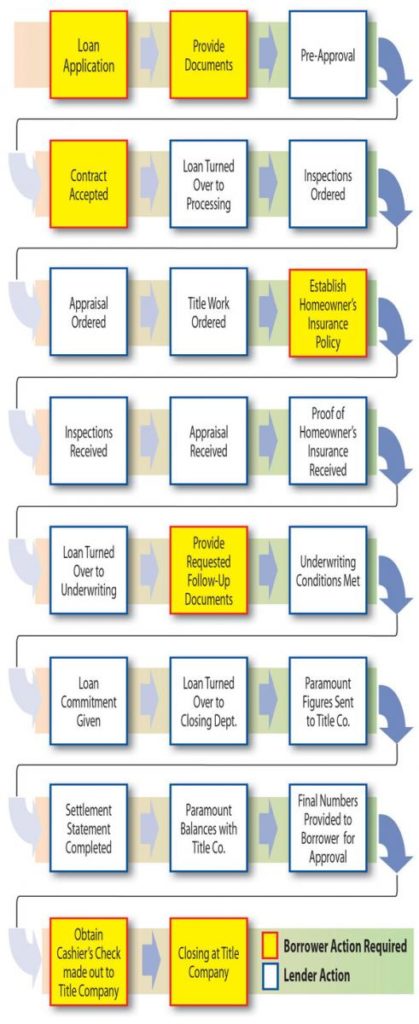

System override and/or manual downgrade of an Accept/Approve to a Refer classification may be required if a particular loan application variable is revealed during loan processing. Underwriters typically use computer programs that automate much of the information gathering and analysis process. This process is called automated underwriting and is the easiest and fastest way to analyze and approve a mortgage.

However, all applicants must apply for the COE to validate their eligibility. A VA loan appraisal is an assessment conducted by an appraiser to determine the property’s actual value and ensure that the house meets all the MPRs. The result of an appraisal can affect your VA home loan application in various ways.

What Is Manual Underwriting For A Mortgage?

Delays in providing requested documentation may not trigger a denial, but they can prevent the loan from closing on time. Here are the most common reasons VA loans get denied and how you can prevent heartbreak during the homebuying process. Lenders might also have restrictions regarding a borrower's ability to obtain an Energy Efficient Mortgage on a manual underwrite.

The biggest advantage of VA loans are that you don’t have to count your Military Basic Allowance for Housing as income or pay monthly mortgage insurance. Therefore, if you receive this monthly BAH, and it covers most or all of your housing costs, your debt-to-income ratio can be lower than 31%. To apply for an IRRRL, get in touch with a VA-approved private lender so that you can submit all the required documents, follow the loan closing process, and pay the closing costs.

Find a Mortgage Expert Near You

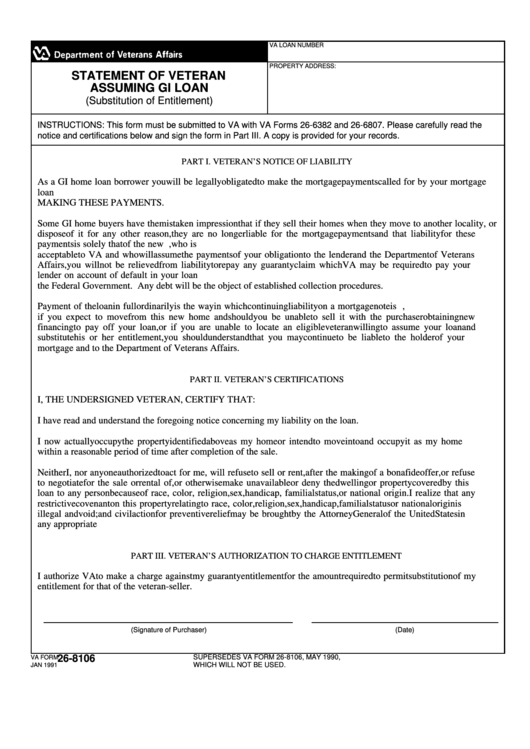

In addition to these, you will also need to submit a copy of your marriage license, the veteran’s death certificate, and separation documents. All active-duty service members are required to submit their Statement of Service. You were discharged due to hardship, reduction in force, or at the convenience of the government. Before starting with the application procedure, it is often recommended to get prequalified for a VA loan. This gives you insight into an appropriate house shopping budget.

With VA home loans, you don’t need to live on the property for most of the year. However, you can earn rental income by living in one house and renting the other. VA home loans are revolutionary mortgage programs that allow people to purchase a primary residence.

Unverifiable or Lack of Stable Income

An award-winning former journalist, Chris writes about mortgages and homebuying for a host of sites and publications. His analysis and articles have appeared at The New York Times, the Wall Street Journal, USA Today, ABC News, CBS News, Military.com and more. You may need bank records, canceled checks, a letter of explanation, and more to satisfy VA lenders. We saw an educational void, so we hired and trained Veterans to fill that void. We think that’s pretty important when you’re considering a huge investment in your future.

Are you a Native American Veteran or a Veteran married to a Native American? Find out if you can get a loan through our NADL program to buy, build, or improve a home on federal trust land. There are two convenient ways for you to contact your Regional Loan Center about non-eligibility related questions. You can obtain your RLC's telephone number, address, and website or e-mail your RLC for Loan Production or Construction & Valuation. Before you buy, be sure to read the VA Home Loan Buyer's Guide.

VA Mortgage Payment Calculator

Lots of borrowers get it; in fact, it’s very rare to just sail through the underwriting process with no hiccups at all. In general, there are three ways the underwriting process can go. At this point, the lender will ask you for some more documents and see to smaller errors or clarifications on the file.

If you are applying for a VA guaranteed loan, choose a loan officer that has experience with VA loans, and more specifically, VA manual underwriting guidelines. Unverifiable income, undisclosed debt and even minor errors like the number of family members can cause problems. The best thing you can do is ensure your information is accurate and bring anything that looks off to your loan officer's attention.

The VA Certificate of Eligibility is one of the most important documents required for the VA home loan process. It stands as evidence to your private lenders that you are eligible for VA loan benefits. If you’re wondering how to apply for a VA loan, you must start by getting your VA Certificate of Eligibility .

From reading the information above, you can see that manual underwriting is not much different than an automated approval. It is important to choose a lender who knows how to get VA mortgages to the finish line. We are experts in VA mortgages and FHA Lend Mortgage does not have any LENDER OVERLAYS to get in the way. This is part of the reason we are able to close more mortgages than many lenders. If you rent from a management company, the lender may send the verification of the rent form. That form will document the dates your payments were received.

The residual income requirement is different based on the region of the country you live in and the size of your family. Once your loan officer has a complete application, they can compute the residual income requirement for you and your family. When you receive an automated approval, there is less paperwork required compared to a manual underwrite. For the most part, you do not need to have a verification of rent completed.

If you have filed for chapter 7 bankruptcy, you will need to wait a minimum of two years from the date of discharge before you’re eligible to enter into a VA mortgage. After the 2-year seasoning, it is possible to receive an automated approval. Sometimes lenders will need to do a closer inspection of your finances to verify you can handle the responsibility of a mortgage. This is called Manual Underwriting, and it does differ from the standard underwriting process. The sooner the underwriter can get to work on your file, the sooner you could be approved and potentially close on your home. Additionally, and perhaps more importantly, the sooner you turn in your documents, the sooner any errors can be found and dealt with.

Lender Appraisal Processing Program The Lender Appraisal Program is a program available to lenders that have met specific requirements. By using an LAPP lender, a VA assigned appraiser can actually close the applicant's loan, allowing for the loan process to be expedited. If AUS doesn’t accept a borrower due to their risk level, their loan will need to go through manual underwriting, which is when a human underwriter goes over the file by hand. A VA loan assumption means that a borrower takes over or assumes a mortgage, given that they are approved for the loan. In simpler words, assumption means signing over your debt to another applicant who can meet all the eligibility criteria and requirements for the loan.

These would need to be repaid or otherwise satisfied before a loan could close. Unpaid debts or liens with the IRS that don’t appear on your credit report can still show up on title work later in the loan process. While it is not necessary for you to have an excellent credit score to qualify for VA loans, you must satisfy the lender’s requirements by having a minimum credit score of 620. If you don’t meet the minimum service requirements for a VA Loan defined by the VA, you might still qualify for the loan if your discharge falls under one of the following categories. Tim Alvis (NMLS #373984) is a residential mortgage loan originator at Veterans United Home Loans and a previous credit expert in the Lighthouse Program. Tim has helped hundreds of veterans and service members with their credit and financial profiles to help them go on to secure the home loan they deserve.